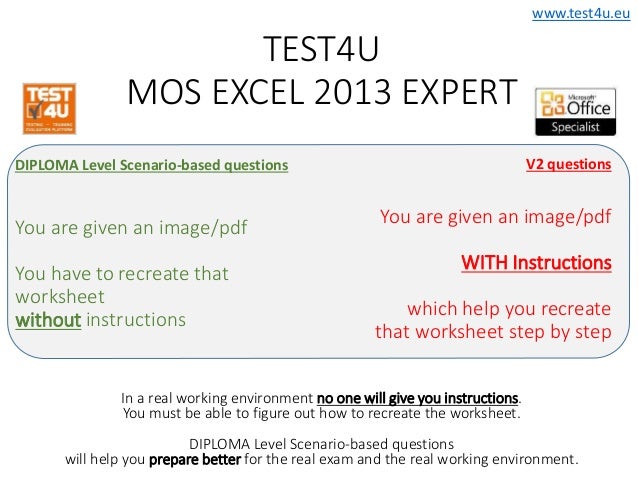

The instructional materials required for this course are included in enrollment. Email capabilities and access to a personal email account.Software must be installed and fully operational before the course begins.Microsoft Word or an equivalent word-processing program.Please note: There may be some differences between your version of Excel and what you see in the course. While Microsoft Excel 2019 is ideal, you can download the desktop version of Excel included with Microsoft 365. Microsoft Excel 2019 (not included in enrollment).Browser: The latest version of Google Chrome or Mozilla Firefox is preferred.This course is not suitable for Oregon residents. In that case, you should instead take the Chartered Tax Professional for California Residents course, which will enable you to meet the CTEC requirements while also earning your professional CTP designation. If you live in California and plan to become a preparer of Federal and/or state income tax returns, you must meet the requirements of the California Tax Education Council (CTEC) to become licensed to practice as a California Tax Preparer. You will also be prepared to pass the Microsoft Office Specialist (MOS) Expert certification exam for Excel.

After successfully completing this course, you will be qualified to prepare individual tax returns and be ready to sit for the IRS Special Enrollment Examination (SEE). taxpayers and best practices for using Excel.

This fully online course will teach you how to prepare individual tax returns for almost all U.S. Come tax season, chartered tax professionals need to use tools like Microsoft Excel to prepare taxes.

0 kommentar(er)

0 kommentar(er)